The New Mandate for Article 6 Carbon Finance Nepal

The mechanism driving the next wave of global climate investment is Article 6 Carbon Finance Nepal. This week’s analysis focuses on how the massive, growing financial gap—driven by the rising cost of emitting carbon in industrialized economies—is creating an essential new mandate for this field.

The global climate market is now defined by binding compliance and rising costs. Leading specialists recognize that the key to unlocking billions in capital lies in understanding this price dynamic and navigating the complexities of international transfer mechanisms. This analysis demonstrates why Nepal is poised to become the world’s most strategic supplier of climate mitigation outcomes.

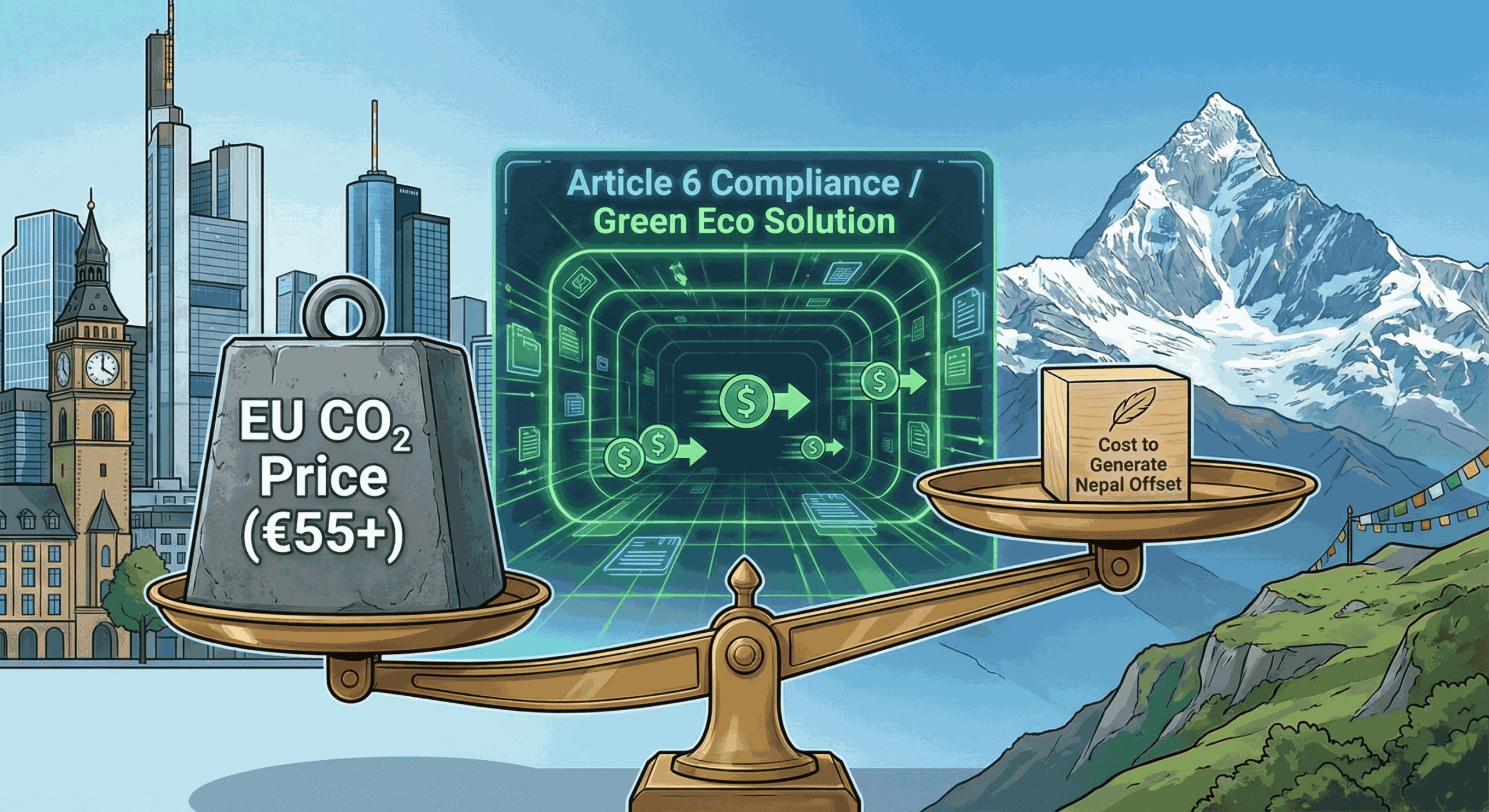

The European Compliance Arbitrage

The cost of emitting CO₂ in Europe is soaring. Analysis of German and Austrian national carbon pricing data confirms that the fixed CO₂ price in 2025 will be €55 per tonne of CO₂ (5, 6), while the broader EU ETS maintains a price range consolidating between €60 and €80 per tonne (7).

This steep escalation means EU companies have a financial imperative to secure cheaper, compliant offsets under the Paris Agreement. The significant price differential creates the perfect environment for scaling Article 6 Carbon Finance Nepal.

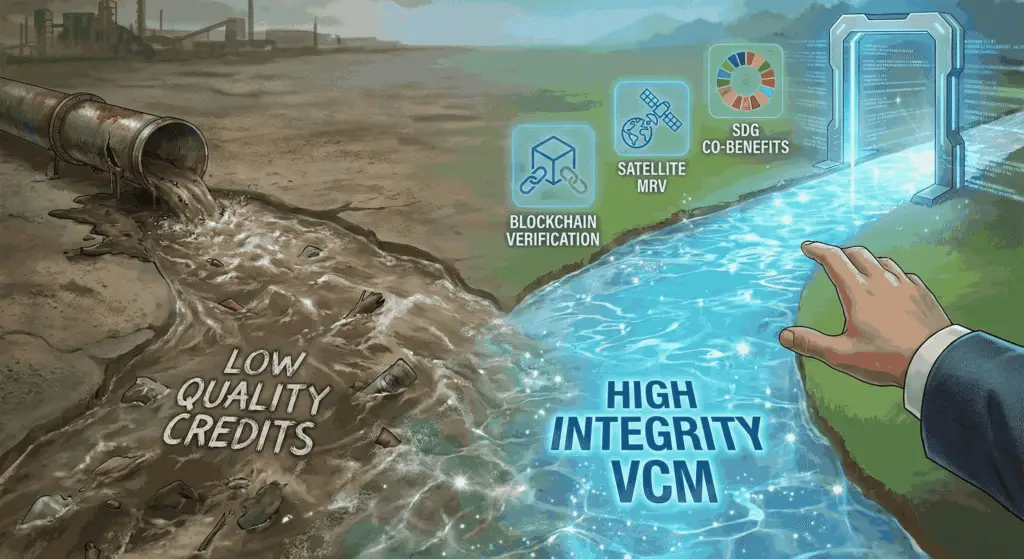

The Bifurcation of the VCM—Quality Drives Compliance

The Voluntary Carbon Market (VCM) is demanding quality, with resilient demand for high-integrity credits (4, 3). This trend confirms that Europe’s high compliance price will only translate into investment if the resulting credits meet the strict quality thresholds required for international transfer under Article 6. The technical complexity of verifying these high-quality offsets is the critical specialization required to manage successful Article 6 Carbon Finance in Nepal.

Article 6 Carbon Finance Nepal Breakthrough

Nepal’s long-term success in community-based forestry and its strategic climate position have allowed it to become one of the world’s first nations to capitalize on this high-priced climate finance.

The Sweden Agreement and ITMO Readiness

Nepal has secured its first-ever bilateral carbon trade agreement with Sweden under Article 6 (8). This confirms that Nepal’s MRV systems are robust enough to generate verifiable, Internationally Transferred Mitigation Outcomes (ITMOs). The nation’s successful REDD+ program, which reduced 2.4 million tons of carbon, now directly feeds into this high-value market, minimizing investor risk and maximizing the scalability of Article 6 Carbon Finance Nepal.

The massive price floor in Europe and the proven high-integrity supply chain in Nepal have created an undeniable developer’s arbitrage.

Our firm specializes in navigating the complex legal, financial, and technical requirements needed to certify credits for high-value bilateral agreements. We are the trusted intermediary converting Nepal’s natural capital into compliant, high-priced ITMOs.

The €55 price floor in Europe is the definitive signal. Green Eco Solution’s role is to close the price gap by guaranteeing that every ton of carbon mitigation generated in Nepal meets the strictest standards for international transfer. We translate Europe’s compliance burden into profitable, verified, and community-centric Article 6 Carbon Finance Nepal demands.

Invest in Compliance-Grade Carbon

The market has spoken: quality is mandatory, and compliance costs are soaring. Nepal’s proven success in forestry, combined with its new Article 6 agreements, makes it the premier destination for investors seeking high-integrity, compliance-grade carbon units.

Partner with Green Eco Solution to secure your stake in the next generation of climate finance and ensure your offsetting efforts are both economically sound and globally verifiable.

Sources & Citations

- CarbonCredits.com. What is the Voluntary Carbon Market?

- Regreener. Voluntary Carbon Market – Latest Prices and Developments.

- Engie Impact. Decoding the Voluntary Carbon Market: Past Trends and Future Engagement.

- Forest Trends. Benchmark Report Finds the Voluntary Carbon Market in Transition: Demand Holding Steady as Turnover Stabilizes.

- Finanztip. CO2-Preis / CO2-Steuer 2025 fürs Heizen und Tanken. (Nov 12, 2025).

- LBBW. CO2-Prognose & Preisentwicklung: ESG-Trends 2025 (Studie). (Jan 21, 2025).

- Wien Energie. Aktueller CO₂-Preis in Österreich. (Nov 17, 2025).

- Setopati. के हो नेपाल र स्विडेनले हस्ताक्षर गरेको कार्बन व्यापार सम्बन्धी सम्झौता? (What is the carbon trade agreement signed by Nepal and Sweden?).

- REDD+ Nepal. रेडप्लस कार्यक्रम, उर्त्सजन न्यूनीकरण कार्यक्रम र कार्बन व्यापारको विषयमा विद्यमान संवैधानिक. (REDD+ Program, Emission Reduction Program and Carbon Trading Policy).