The New Era of Global Climate Finance

The world of global sustainability and carbon finance is accelerating, driven by the urgency of the 1.5°C goal. Following the decisive outcomes of COP30 in Belém, Brazil, the framework for the future of compliant, high-integrity carbon credits Nepal is now transitioning from political ambition to mandatory market infrastructure.

This seismic shift creates an opportunity for nations rich in natural capital, like Nepal. Leading specialists in this field monitor these policy developments weekly, recognizing that success in the burgeoning carbon economy relies on the ability to bridge complex international rules with effective local project implementation.

This week, we dissect the crucial COP30 decisions on Article 6 and demonstrate why recent domestic policy moves in Kathmandu have perfectly positioned Nepal to become a leading source for high-value, compliant Internationally Transferred Mitigation Outcomes (ITMOs).

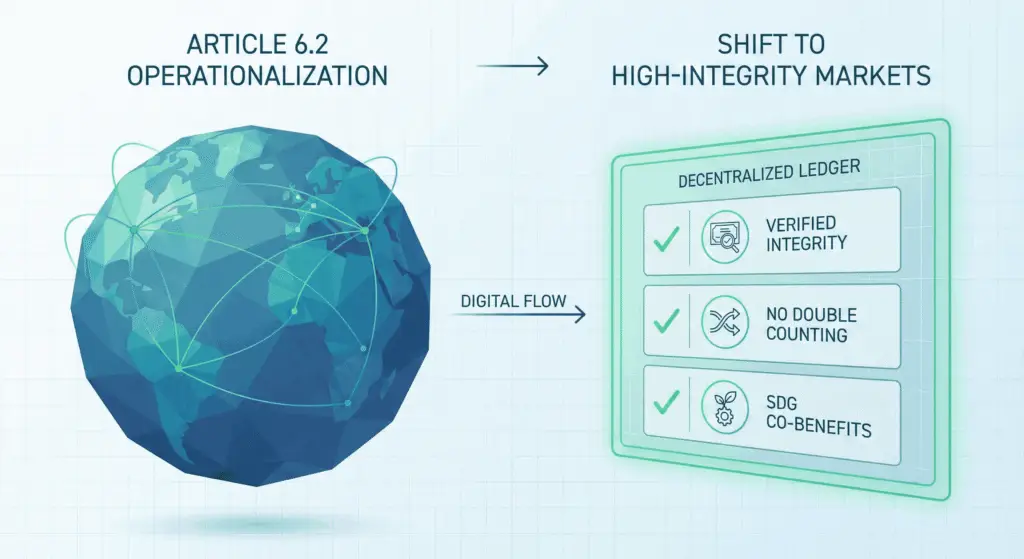

Global Policy Breakthrough – Article 6 is Now Operational

The centerpiece of climate diplomacy at COP30 was the finalization of crucial guidance for Article 6. This mechanism, designed to govern the international transfer of emission reductions, is finally gaining the clarity the market needs.

Key Global Developments Post-COP30:

PACM Operationalization:

The new Paris Agreement Crediting Mechanism (PACM), established under Article 6.4, is now fully funded and advancing its procedural rules. Crucially, COP30 extended the deadline for projects to transition from the CDM to PACM to June 30, 2026 (4).

Focus on Integrity:

The international community underscored the requirement for high-integrity carbon credits that deliver genuine, permanent, and verified co-benefits. The rigorous tracking demands confirm that the future belongs only to verifiable high-integrity carbon credits Nepal can provide (3).

Bilateral Trading Momentum (Article 6.2):

High-profile bilateral agreements, such as the one recently signed between Singapore and Malawi, demonstrate that Article 6.2 trading is actively moving forward (2).

The future belongs to projects that can prove technical compliance, demonstrate clear community benefits, and operate within a transparent national framework.

The Strategic Window for High-Integrity Carbon Credits Nepal

The new global rules directly intersect with domestic policy developments from the Government of Nepal (GoN). The ability to navigate this intersection defines the success of any operation targeting high-integrity carbon credits Nepal.

Nepal’s Response: Preparing for a Compliance Gold Rush

Nepal’s approach in 2025 signals a decisive move to capitalize on the new market.

Policy Certainty: The Fiscal Year 2025/26 budget officially announced that a “clear policy framework for carbon trading” will be established (5). This high-level government commitment is the single most critical step towards de-risking private sector investment.

Infrastructure Development: In partnership with the UN Development Programme (UNDP), the country has initiated tenders to establish a national carbon registry, design a carbon pricing policy, and create a carbon finance handbook (6). This proactive focus on robust Monitoring, Reporting, and Verification (MRV) is precisely what the Article 6 framework demands.

Shifting Value Proposition: Nepal has historically participated in results-based agreements priced around $5 per tonne (8, 9). In stark contrast, the emerging compliance and high-integrity voluntary markets are seeing prices often exceeding $20–$40 per tonne (7). This massive delta underscores the imperative to produce premium, high-integrity carbon credits Nepal can market globally.

Our Analysis:

By actively developing a national registry and clear pricing policy, Nepal is signaling its readiness to move toward the higher-value markets of Article 6.2 and 6.4. This shift will unlock billions in climate finance for Nepal’s sustainable development goals—provided that domestic projects meet the heightened standards of integrity and transparency now mandated by global policy.

The convergence of global policy clarity and domestic political will marks the most exciting time for sustainable development in Nepal’s history. Only firms specializing in local execution and international compliance can successfully generate verified high-integrity carbon credits Nepal.

The transition to Article 6 demands a partner capable of bridging policy complexity with on-the-ground project integrity. This specialized requirement is the new entry point for climate finance.

The world’s climate capital is now flowing through Article 6, and Green Eco Solution is the indispensable bridge ensuring that capital lands responsibly in Nepal. We are poised to transform Nepal’s environmental assets into compliant, high-value carbon credits, securing our national Net-Zero 2045 ambition while delivering prosperity to the grassroots. Integrity is not just a standard—it is our business model.

Conclusion

The path to global sustainability runs through compliant, internationally recognized carbon markets. With COP30 finalizing the rules and Nepal laying the domestic groundwork in 2025, the opportunity for corporate partners and investors to engage with projects producing high-integrity carbon credits Nepal offers has never been greater.

Sources

- DLA Piper. All eyes on carbon markets amid belated progress and domestic challenges.

- Africa Sustainability Matters. Malawi joins Singapore’s growing Article 6 network with new carbon market agreement. November 28, 2025.

- Mayer Brown. COP30 Approves Key Decisions on Paris Agreement Market Mechanisms. November 25, 2025.

- Argus Media. Cop: Article 6 talks extend CDM-Pacm transition period. November 25, 2025.

- Corporate Nepal. Budget FY 2025/26: Clear policy will be made for carbon trading. May 29, 2025.

- Carbon Pulse. Nepal launches UNDP-backed tenders to build national carbon market framework. October 13, 2025.

- The Kathmandu Post. Nepal’s carbon market potential. May 20, 2025.

- The Himalayan Times. Nepal’s Carbon Trade: Big Hopes, Small Gains. May 4, 2025.